Key Metrics: What Makes SaaS, Marketplace, E-Commerce and Hardware Startups Interesting for VCs?

There are specific metrics VC funds are looking at when reviewing companies and deciding on whether to invest or not. Recently local investment fund LAUNCHub Ventures brought Enis Hulli, partner at 500 startups Istanbul, in Sofia to explain the perspective of his fund. As we found the seminar quite useful, we decided to summarize Hulli’s perspective. Of course, note that this is one point of view coming from an early stage investment fund, even if its one with over 1800 investments worldwide like 500 startups.

The most important metrics Hulli is looking at are the market qualities, the retention, and the unit economics. Depending on the stage and the industry, one of them is always more important. In any case, data is the fuel for decision-making. Here’s what else he shared for the specific domains in which his team has invested or reviewed companies, specifically in seed and series A stage.

SaaS – lifetime value, CPA, payback period

SaaS is driven by unit economics (the direct revenues and costs associated with a particular business model – ed. note), and retention and engagement don’t play such a role. Investors would rather want to what the economics per unit is. It means that for accounting or HR software or an ERP system, they want to see that a customer pays at least three times the cost that the company has paid to acquire him. In other words, the lifetime value (LTV) over the customer acquisition costs must be triple higher.

VCs would also like to see that the business has or is able to have negative churn (measures how fast a company loses users). “If I’m acquiring 100 customers today, they are paying $100 this month and in year from now only 95 of them are here but they pay me $110 USD – that’s okay. In other words – even if I’m not growing my user base, I can grow within my user base almost unlimited and upsale”, Hulli explained.

According to him, investors would also like to understand the payback period and they find up to 12 months okay, depending on the ticket of course.

Another important metric is the activity of the customer base. “A lot of the small ticket SaaS companies have this customer base of people who are paying but not using the product. Sooner or later those customers will churn out”, he said. So it would be useful to know what’s the percentage of paying customers who are actually using the product every month.

E-Commerce – channels, conversion rates

E-commerce is also unit economics-drive – the cost per acquisition and the scalability of sales channels are the important metrics. This business is transactional driven and VCs try to understand the gross margin within a product – they are interested in conversion rates and how are they changing over time. “If you are not Amazon, e-commerce is paid acquisition heavy. Only 1%-2% of the customers will be acquired through organic channels”, he explained. So a VC wants to see on the one hand how many customers could be acquired with the cash they invest and on the other, whether the channel is scalable. “Facebook ads means scalability, posting on Facebook groups and forums on the contrary – not. We want to see paid customer acquisition on scalable channels”, he indicated.

However, if an e-commerce business eyes on being acquired, the founders should be focusing on direct channels once they’ve build a brand, because bigger players would be interested to buy the specific channel the company has created. “Direct to consumer models are usually disrupting a channel, 80% of the revenues should be coming through a direct channel, the other 20% is only for brand building”, he said.

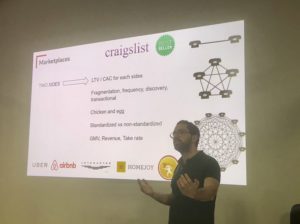

Marketplaces – transactions, frequency, tickets

Marketplaces are a tough business as they have two sides – the supply and demand, and VC look at them separately. A good market place is fragmented and in best case, it standardizes a non-standard service. “For example with food delivery marketplaces – you need to have a lot of food places and you need to set a standard, so the customers know what to expect. The same with Uber”, Hulli said.

Good marketplaces are also transactional – they not only listing services, but the payments happen within the platform as well. Otherwise, the platform could get cut off. HomeJoy, the US home cleaning marketplace, is great example for how it’s not done – they closed $40M from Y Combinator and went bankrupt some time later. The reason: a lot of the buyers and sellers were not getting that much value out of the product after certain time, so they bypassed the platform and stopped giving it a cut.

Another key metric is frequency vs. ticket size. “If you think of Uber – they get a dollar from my ride to the airport today, but as I use them ten times a month they’re gaining. There’s also the opposite – Jetsmarter – they rent jets, so it’s not a problem even the user base uses it once a year, because the ticket is €10K. Bad companies are the ones that have low frequency and low ticket size”, Hulli explained. An example for a bad business case is the Spanish Trip4real that was acquired by Airbnb, which connects travelers to locals who arrange tours and activities for their visit. “The frequency is low because it’s targeting tourists, and the price is low”, he said.

Apart from that, of course with marketplaces, there’s always a huge chicken egg problem. A lot of marketplaces solve this by manipulating the supply. They buy their own supply – like HomeJoy that employed their own cleaners in the beginning. One of the main things is to satisfy the supply – the aims should be to make the platform a primary source of income to the supply. VCs look on monthly basis at the active demand and supply users – this shows them the elasticity and what’s the bottleneck.

Hardware – software revenues, gross margins

When it comes to hardware, VCs mostly invest into business model disruption rather than the technology itself. “We don’t think the technology differentiation is venturable and sustainable in the long run”, Hulli said.

Investors are looking at gross margins and according to Hulli, good hardware businesses have 70% gross margins. An example for such case: Apple used to be a hardware company until 2017 and their key metric was the number of computers and devices sold. Than it changed, when they saw they cannot penetrate the market further and Apple became a services company, which started pushing software services like podcasts, music, etc. In other words, VCs are interested in hardware companies that have a large software revenue model around the hardware. Another good example is Peloton, a US startup that sells in-house fitness bicycles, connected to a fitness studio via display that allows a more engaging fitness experience out of home. The bike itself starts at $2.2K and it comes with a monthly subscription that allows users to be part of the fitness studio experience. “If you have paid 2K for the bike, more than sure you’ll pay for the subscription as well”, Hulli laughed.